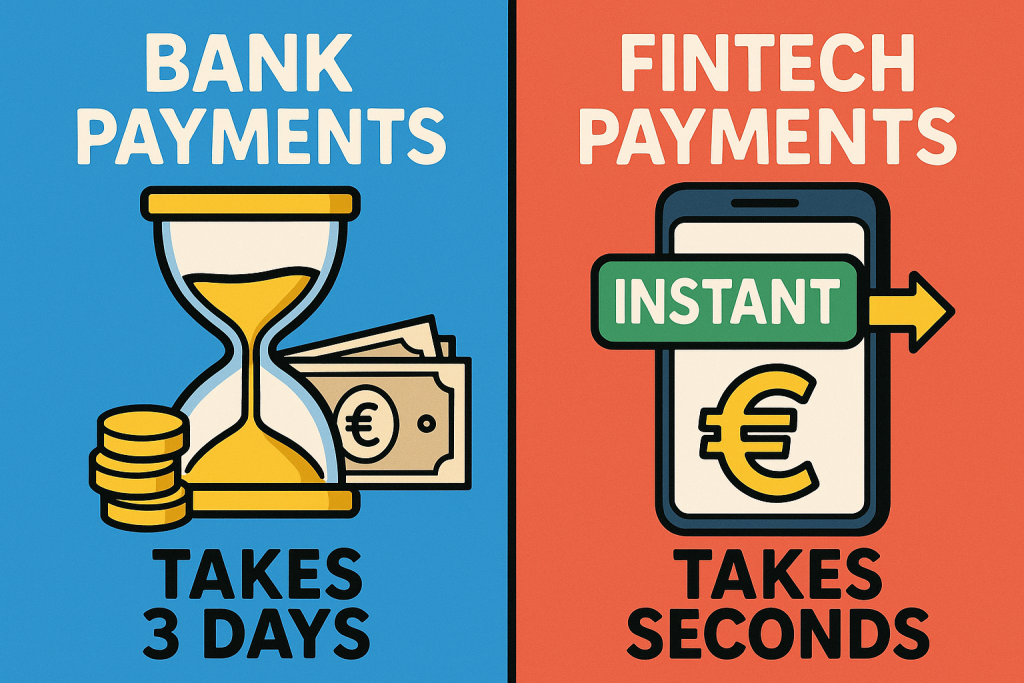

For decades, banks told us that transferring money takes three working days. It sounded reasonable — until fintech arrived and proved it was never about technology at all.

🏦 The Myth of “Processing Time”

For most of modern banking history, delays were justified by “overnight clearing” or “batch processing.” Customers were told that money needed time to “settle.”

But by the 1990s, computers were perfectly capable of real-time transactions. Internal transfers within the same bank were often instant — yet balances were still held back. The reason wasn’t technical; it was institutional.

💰 The Real Reason: The Float

The float — the period between debit from one account and credit to another — generated billions in hidden profits. While your funds were “in transit,” they sat in pooled accounts earning overnight interest for the bank.

For the customer, that money was already gone. For the bank, it was still working — quietly compounding returns day after day.

🧑⚖️ Political Inertia and Banking Lobbying

When consumer groups and policymakers began demanding faster payments, large financial institutions pushed back.

They claimed instant payments would increase fraud risk and require costly system upgrades. Governments, often reliant on bank stability and liquidity, accepted the argument.

The result: decades of delay disguised as “prudence,” while customers unknowingly financed the system’s inefficiency.

💡 Fintech Breaks the Illusion

Everything changed when fintech challengers like N26, Revolut, and Wise (formerly TransferWise) arrived. Their apps moved money instantly — sometimes across borders — and at transparent, near-zero cost.

Customers began asking the obvious question:

“If I can send money abroad in seconds, why does my domestic transfer still take days?”

That question broke the spell.

🇪🇺 Europe Finally Acts

The European Union responded with the Second Payment Services Directive (PSD2) and the SEPA Instant Credit Transfer (SCT Inst) system.

-

- Launched: 2017

- Mandated: 2024, with full compliance required by 2025–26

Under this law, all EU banks must offer instant euro transfers 24/7 at no extra charge.

Even conservative institutions like Santander, Barclays, and Deutsche Bank have now adopted instant payments, finally aligning with what fintechs proved was possible years ago.

🌍 A Global Shift Toward Real-Time Banking

-

- United Kingdom: Introduced Faster Payments in 2008 — a major step forward. Initially, some banks charged modest fees; today, most domestic transfers are free for personal accounts.

- India: The Unified Payments Interface (UPI), launched in 2016, made instant transfers completely free and is now used by over a billion people.

- Brazil: PIX, launched in 2020, offers 24/7 real-time transfers — also free for individuals and a fraction of the cost for businesses.

- United States: Only caught up in 2023 with the Federal Reserve’s FedNow service, which is still rolling out gradually.

⏳ The Lesson: Time as Currency

For decades, banks didn’t need three days to move your money — they needed three days to make money from your money.

Fintechs exposed the fiction. The new laws merely confirm what the technology had shown all along: that time, like capital, belongs to those who create it.

“It is difficult to get a man to understand something, when his salary depends upon his not understanding it.” — Upton Sinclair